Dr Dhiraj, writing for DifferentTruths.com, explores how mid-cap mutual funds act as market engines, driving transformation and long-term wealth.

AI Summary

- Growth Engines: Mid-caps occupy the “sweet spot” between stability and volatility, capturing companies scaling into future market leaders.

- Risk vs. Reward: While offering higher historical returns than large-caps, they require greater emotional discipline to navigate sharper market swings.

- Strategic Role: Best used as portfolio enhancers rather than foundations, they thrive under supportive RBI policies and long-term investment horizons.

Why Mid-Caps Are Called the Engines of the Market?

If large-cap companies provide stability to the stock market, mid-cap companies provide momentum. They are often described as the engines of the market because this is where expansion, ambition, and transformation are most visible. Mid-cap mutual funds invest in companies that are no longer small but not yet dominant—businesses that are scaling operations, entering new markets, and benefiting from structural changes in the economy.

This stage of growth makes mid-cap investing particularly attractive, but also more demanding in terms of patience and discipline.

What Exactly Are Mid-Cap Mutual Funds?

SEBI defines mid-cap stocks as companies ranked from 101 to 250 by market capitalisation. For a scheme to be classified as a mid-cap mutual fund, at least 65 percent of its assets must be invested in these companies. This standardised definition ensures that investors are not misled by fund names and can clearly understand the nature of the risk they are taking.

Mid-cap mutual funds therefore sit squarely between large-cap funds, which focus on market leaders, and small-cap funds, which invest in much smaller and more volatile businesses.

The Growth Advantage of Mid-Cap Companies

Mid-cap companies often operate in sectors that are expanding faster than the overall economy. Many are beneficiaries of trends such as manufacturing expansion, infrastructure spending, rising consumption, digitisation, and export growth. Because they start from a smaller base, even moderate increases in revenue or profitability can translate into strong earnings growth.

Historically, this growth has been reflected in performance data. Over long periods, mid-cap indices in India have delivered higher average returns than large-cap indices, although with greater volatility. For example, over extended 10–15 year horizons, mid-cap indices have often outperformed large-cap benchmarks, but the journey has included sharper ups and downs along the way.

This is why mid-cap mutual funds are often seen as return enhancers rather than foundational holdings.

From Mid-Cap to Market Leader: The Transition Story

One way to understand mid-caps is to view them as tomorrow’s large companies. Several well-known Indian businesses spent years in the mid-cap segment while building scale and credibility. Companies such as Trent, Dixon Technologies, Tube Investments of India, Tata Elxsi, and Page Industries have, at different points in time, represented this transition phase—benefiting from strong execution, favourable industry trends, and improving balance sheets.

Mutual funds allow investors to participate in such growth stories without the need to identify individual winners early, which is difficult even for experienced investors.

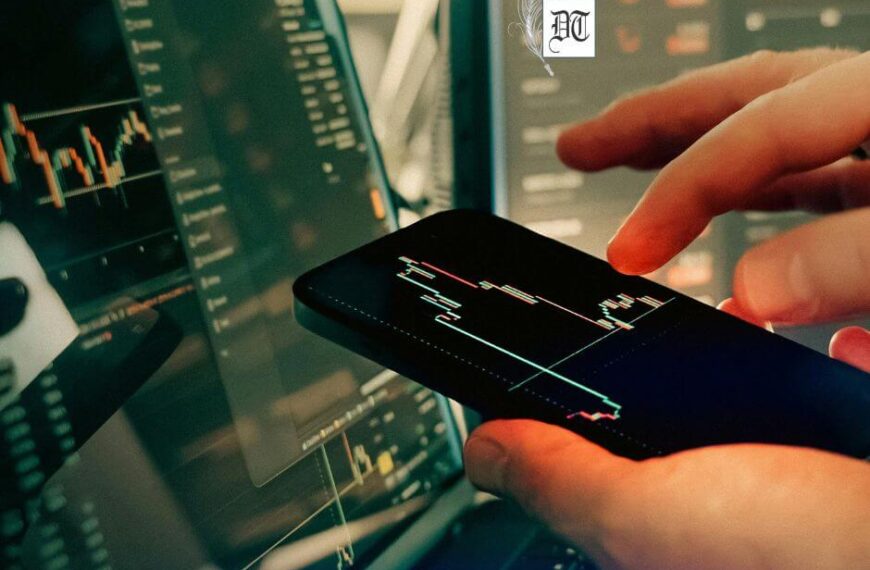

Volatility: The Price of Higher Growth

The same characteristics that create opportunity also create risk. Mid-cap companies are more sensitive to economic conditions than large-cap firms. They often have higher borrowing needs, narrower margins, and less pricing power. As a result, during periods of economic stress or market correction, mid-cap stocks tend to fall more sharply.

Historical data shows that during major market downturns, mid-cap indices have declined more than large-cap indices. However, they have also tended to recover faster and more strongly when conditions improve. This uneven journey explains why mid-cap investing can feel emotionally challenging.

The Role of RBI Policy and Economic Cycles

Mid-cap performance is closely linked to business cycles and monetary conditions. RBI policy decisions on interest rates, liquidity, and inflation management directly affect borrowing costs and demand conditions. When interest rates rise and liquidity tightens, mid-cap companies often feel pressure sooner than large corporations. Conversely, when the RBI adopts a supportive stance, mid-cap companies are frequently among the biggest beneficiaries.

For instance, during periods of economic recovery supported by accommodative monetary policy, mid-cap earnings growth has historically accelerated faster than that of large-cap companies. This sensitivity amplifies both risk and reward.

Why Discipline Matters More Than Timing?

Mid-cap mutual funds are not suitable for short-term investing or tactical bets. Attempting to time entry and exit in this category often leads to poor outcomes. Data on investor behaviour consistently shows that many retail investors enter mid-cap funds after strong rallies and exit during corrections, locking in losses.

Successful mid-cap investing depends less on timing and more on staying invested across cycles. Investors who remain disciplined during downturns have historically been rewarded during subsequent recoveries.

Portfolio Role: Complement, Not Replacement

From a portfolio perspective, mid-cap mutual funds work best when combined with large-cap funds. Large caps provide stability and downside protection, while mid-caps add growth potential. This combination allows investors to participate in economic expansion without concentrating risk in one segment.

For most retail investors, mid-cap exposure should form a portion of the equity allocation rather than the entire portfolio. This balance helps manage volatility while improving long-term return potential.

SEBI Oversight and Investor Protection

SEBI plays a crucial role in protecting investors in the mid-cap space. Mid-cap mutual funds are required to clearly disclose their risk level, typically categorised as High Risk under the Risk-O-Meter. Monthly portfolio disclosures allow investors to see exactly which companies the fund holds and how concentrated the exposure is.

Expense ratios are capped, and fund objectives are clearly defined, reducing the risk of mis-selling. While market risk cannot be eliminated, governance risk is significantly reduced through regulation and transparency.

Who Should Consider Mid-Cap Mutual Funds?

Mid-cap mutual funds are suitable for investors with a longer time horizon, the ability to tolerate volatility, and the emotional discipline to stay invested during market downturns. They are not appropriate for money needed in the near future or for investors who are uncomfortable with interim losses.

For those who understand and accept these conditions, mid-cap mutual funds can play a powerful role in long-term wealth creation.

Growth with Responsibility

Mid-cap investing is not about chasing high returns or following short-term rankings. It is about participating responsibly in the growth phase of businesses and the economy. When approached with patience, diversification, and realistic expectations, mid-cap mutual funds can significantly enhance portfolio outcomes.

The Final Words…

Mid-cap mutual funds test temperament more than intelligence. Mid-cap mutual funds remind investors that growth is rarely linear. The journey may be uneven, but patience often proves more valuable than precision. Mid-cap investing is not about timing the market; it is about trusting time in the market. That distinction often makes all the difference!

In the next column, we will examine the most volatile—and potentially most rewarding—equity category of all: small-cap mutual funds, where opportunity is highest but caution is paramount.

Picture design by Anumita Roy

Dr Dhiraj Sharma is a faculty member in the Department of Management Studies at Punjabi University, Patiala. He has authored fourteen books and published over a hundred research papers, articles, and book-chapters in reputed national and international journals, books, magazines, and web portals. Beyond academia, he is a nature and wildlife photographer and a realistic and semi-impressionist painter.