Rita’s exposé for DifferentTruths.com reveals how India’s middle class faces financial ruin, trapped by foreign-owned hospitals, pharma, and insurance firms profiting from the pain of the sick.

AI Summary

- Foreign investors control 51-80% of major hospital chains like Manipal and CARE, driving skyrocketing bills post-COVID.

- Big Pharma giants (Sun Pharma, Cipla) and insurers (Niva Bupa, ICICI Lombard) hold 20-67% foreign stakes, inflating costs.

- Affordable options like Jan Aushadhi are sidelined, leaving middle-class Indians squeezed in a profit-maximising “deadly triangle”.

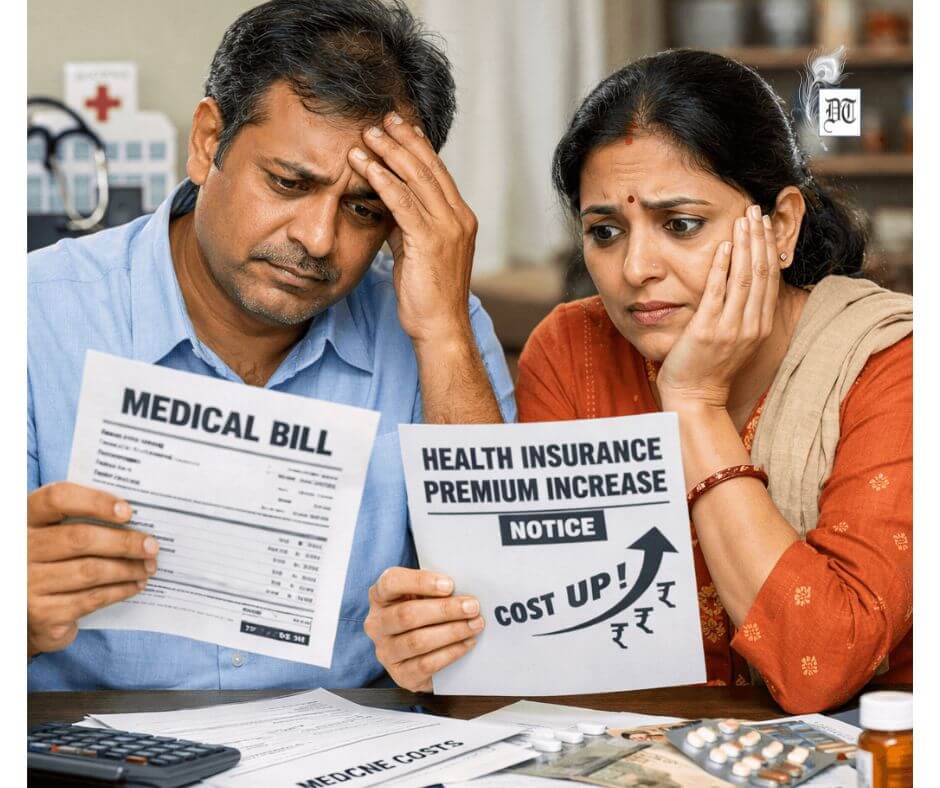

Have you noticed how terrifying it has become to fall sick in India lately?

It is no longer just an inconvenience or an expense; it has become a financial crime. This is especially true if you belong to the middle class. We feel it viscerally: doctors’ fees are high, hospital bed charges are astronomical, and essential medicines now feel like luxury products.

While medical inflation has always existed, this trend exploded in the aftermath of the COVID-19 pandemic. Everyone complains about the bills, but hardly anyone asks why it is happening with such synchronised aggression.

I decided to stop complaining and start asking why. What I found was disturbing.

Quality, affordable healthcare is being systematically syphoned away from the Indian middle class. This isn’t random inflation. It is the result of a specific, profit-maximising model perfected in the West that has now arrived on our shores with full force.

We are currently caught in a deadly triangle designed to extract maximum value from human sickness.

The First Corner: The Hospital Takeover

Between 2022 and 2024, approximately $4 billion flowed quietly into Indian hospital chains. This wasn’t charitable giving; these were precise, strategic acquisitions.

If you look at major chains—Manipal Hospitals, CARE, KIMSHEALTH, HCG Oncology, Aster, Rainbow, and others—you will find that most now have 51% to 75% foreign ownership. Western companies are aggressively buying stakes, replacing local hospital ecosystems in every district.

Key Examples of Foreign Ownership

Manipal Hospitals: Around 59% owned by Singapore’s sovereign fund, Temasek.

CARE Hospitals: A majority stake (around 73%) is held by US private equity firms.

KIMSHEALTH (Kerala Institute of Medical Sciences): Controlled by Blackstone (around 80%).

Healthcare Global (HCG) Oncology: Majority stake (over 60%) held by European PE (CVC Capital).

Rainbow Hospitals: Minority stakes held by UK government funds and Dubai PE.

Sahyadri Hospitals: Fully owned by Canada’s Ontario Teachers’ Pension Plan (OTPP).

The result of this corporate takeover is the standardisation of billing and the normalisation of “sticker shock”. But hospitals are only one side of the operation.

The Second Corner: Big Pharma’s Foreign Hand

Look closely at the pharmaceutical industry. Every major Indian pharma company now has significant Western investors. Giants like Sun Pharmaceutical, Dr Reddy’s, Cipla, Lupin, and Zydus all have foreign ownership ranging between 20% and 35%.

The Third Corner: The Insurance Trap

The final point of the triangle is medical insurance. Insurance is now mandatory at many workplaces and is sold aggressively on television using fear as the primary marketing strategy.

Yet, look at who owns them. Most major players—Niva Bupa, HDFC ERGO, ICICI Lombard, Bajaj Allianz, and Tata AIG—are joint ventures or foreign-controlled entities. Foreign stakes range from 26% to 67%, and regulations now allow some to go up to 100%.

Connecting the Dots

When you connect this triangle, the design becomes clear. The model works like this: Hospitals inflate bills. Pharma supplies premium-priced medicines. Insurance companies collect massive premiums.

The squeeze on the common citizen is devastating. A bypass surgery that cost ₹2.5–3 lakh in 2010 now costs anywhere between ₹6–10 lakh in 2025—a jump of nearly 200%. Bed charges and ICU rates have risen even faster.

“But I have insurance,” you might say. The reality is grim there, too. Industry estimates suggest that nearly 60-70% of claims face significant deductions or outright rejection at the time of need. The rest must be paid by eviscerating life savings or taking predatory loans.

If you dig deep enough and follow the money, you will often see the same large investment firms holding stakes across all three sectors: hospitals, pharma, and insurance. This is not a coincidence. It is by design. In this ecosystem, the balance sheet is far more important than healthcare.

The Illusion of Choice

The most tragic part is that affordable alternatives exist, but they are suppressed.

Bharat runs Jan Aushadhi Kendras, which offer medicines with the same chemical composition—the same salt, the same molecule—at prices 80% to 90% lower than branded versions. Yet, doctors rarely prescribe them. Not because they don’t work, but because prescribing a ₹40 strip instead of a ₹400 strip doesn’t feed the ecosystem.

The cartel protects itself.

Where does this leave the honest middle-class Indian? Nowhere. We pay our taxes. We pay our insurance premiums. We pay inflated hospital bills. And at the end of it all, we still have to beg for financial dignity when illness strikes.

This is no longer healthcare. This is a financialised, Western-designed medical economy operating on Indian soil.

Picture design by Anumita Roy

By

By

By

By